The landscape of digital asset acquisition is evolving rapidly, with major SaaS companies increasingly focusing on purchasing media properties to enhance their market presence. This analysis examines Nick Eubanks’ strategic framework for building and selling digital assets, particularly in the context of SaaS acquisitions.

The rising costs of traditional paid media channels have pushed companies toward alternative growth strategies. Google’s cost per lead has increased by 19% year-over-year, while average CPC has risen over 90% since 2020. These market conditions have created new opportunities for digital asset builders and sellers.

The Strategic Value of Owned Media

Click Share Dominance

The fundamental concept driving owned media acquisitions is click share—the portion of total clicks a company can capture across relevant keywords. Key findings from Eubanks’ analysis show:

- Organic results capture approximately 85% of clicks across mobile and desktop

- Top position typically receives around 20% of organic clicks

- Owning multiple positions can increase click capture to 50-70%

- Multiple owned properties increase probability of user engagement

Types of Valuable Digital Assets

The market primarily values five categories of digital assets:

- Blogs

- Online communities

- Publishers

- Applications

- Newsletters

Valuation Models: Monetized vs Non-Monetized Assets

Monetized Asset Valuation

Traditional monetized assets are valued based on EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Example metrics:

- TTM Revenue: $300,000

- 20% Operating Margin

- EBITDA: $60,000

- Typical Exit Multiple: 3x

- Approximate Valuation: $180,000

Non-Monetized Asset Valuation

Non-monetized assets are valued based on strategic traffic value:

- Monthly Traffic: 300,000 visits

- Referral Rate: 1.5%

- Conversion Rate: 1%

- Average Revenue per Conversion: $200

- Strategic Multiple: 3x

- Approximate Valuation: $324,000

SaaS Company Valuation Metrics

Key metrics SaaS companies consider when valuing digital assets:

- Customer Acquisition Cost (CAC)

- Monthly Recurring Revenue (MRR)

- Lifetime Value (LTV)

- First Payment Conversion Rate

- Traffic-to-Lead Conversion Rate

Case Study: Building a $10M Digital Asset

Target Market Selection

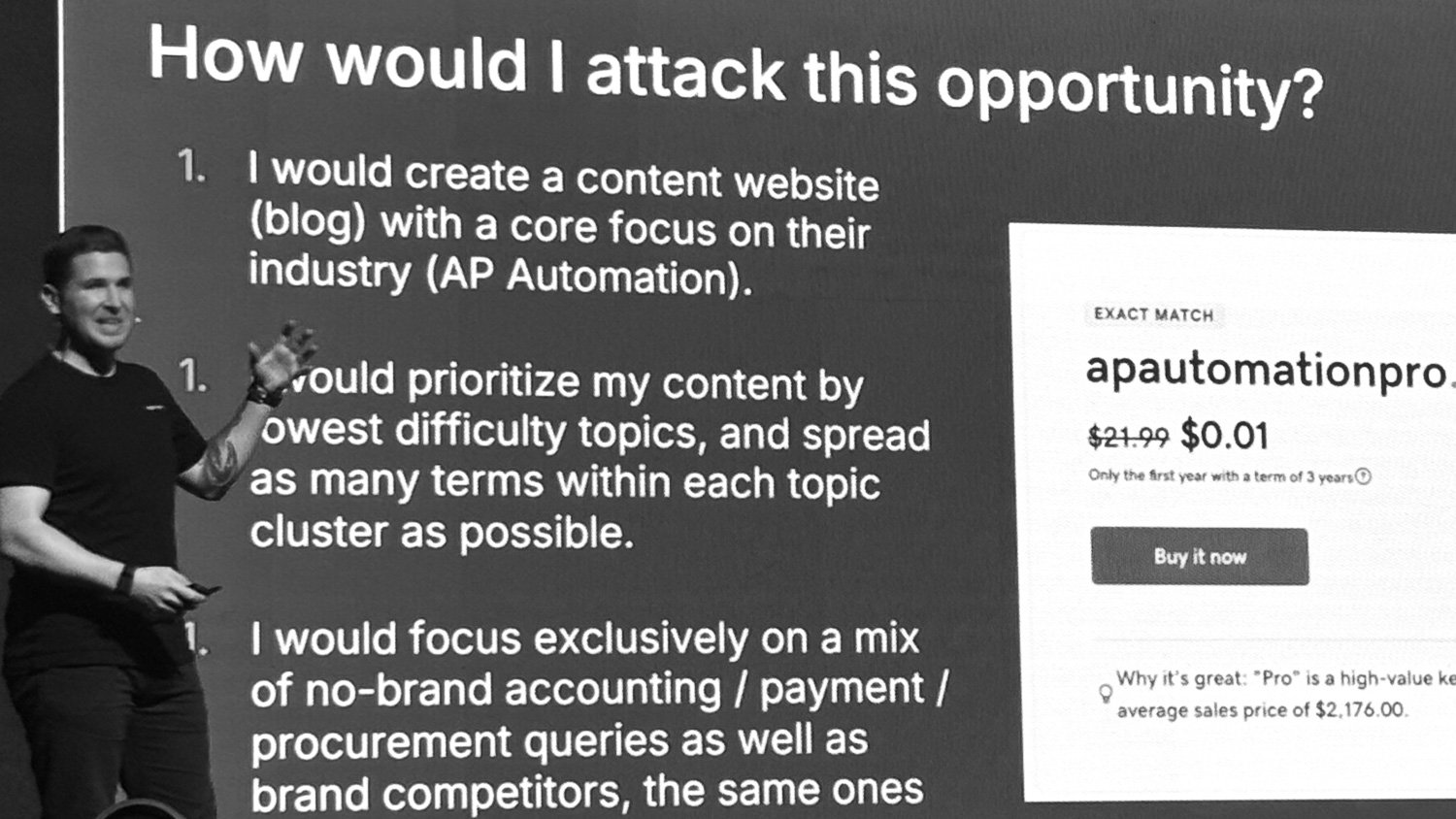

Demonstrated example in payments automation vertical:

- Target Buyer: Enterprise SaaS company (e.g., Tipalti)

- Market Cap: $8.3B+

- Focus: Non-brand accounting, payment, procurement queries

Investment Requirements

Initial 12-month investment structure:

- Content Creation: $20,000/month ($2,000 per article, 5 pieces monthly)

- Link Building: $50,000 initial campaign ($1,000 per link, 50 links)

- Total Investment: $270,000

Traffic and Conversion Targets

- Goal: 100,000 monthly visits

- Content Requirements: 200 pieces

- Average Content Performance: 500 organic visits per piece after 5 months

- Timeline: 30 months to reach traffic goal

Financial Projections

- Referral Rate: 1%

- Conversion Rate: 0.25%

- First Payment Value: $10,000

- Customer LTV: $450,000

- Monthly First Payments: $25,000

- Monthly LTV Generation: $450,000

Action Items for Asset Builders

- Domain Selection

- Purchase exact match or modified exact match domain

- Focus on specific vertical terminology

- Timeframe: Month 1

- Content Strategy Development

- Map lowest difficulty, highest impact keywords

- Create content calendar for first 6 months

- Budget $2,000 per piece minimum for quality

- Timeframe: Month 1-2

- Link Building Campaign

- Allocate $50,000 for initial campaign

- Target 50 high-quality links minimum

- Focus on industry-specific placements

- Timeframe: Months 6-12

- Content Production System

- Establish production workflow

- Create style guide and templates

- Implement quality control process

- Timeframe: Month 2-3

- Performance Tracking

- Set up analytics and tracking

- Monitor key conversion metrics

- Document traffic growth and patterns

- Timeframe: Ongoing

- Content Optimization

- Review and update content after 6 months

- Focus on underperforming pieces

- Expand successful topics

- Timeframe: Month 7+

- Exit Planning

- Document all processes and systems

- Prepare financial models and projections

- Build relationship with potential buyers

- Timeframe: Month 24+

Implementation Considerations

Technical Requirements

- Professional CMS implementation

- Advanced analytics setup

- Content management system

- Link monitoring tools

- Performance tracking dashboard

Risk Factors

- Market condition changes

- Algorithm updates

- Competition increases

- Buyer market changes

- Content quality maintenance

Summary

Building valuable digital assets requires significant upfront investment but can yield higher returns than traditional monetized websites. Success depends on strategic market selection, quality content production, and proper positioning for acquisition. The key is focusing on traffic quality and conversion potential rather than immediate monetization.

For SaaS companies, the value proposition centers on predictable customer acquisition costs and favorable unit economics. A well-executed digital asset can deliver customers at a lower cost than traditional paid channels while providing sustainable competitive advantages through owned media positions.